For many Americans, the name “Alice” conjures up visions of a fantasy tea party with a precocious hat maker and a mercurial hare. For families chasing the ever-elusive vision of financial stability through multiple and very real roadblocks, however, making ends meet is anything but whimsical. ALICE stands for Asset Limited Income Constrained Employed, and as of 2019, a whopping 49% of US households fell into this category.

Here’s what you need to know about Americans who are ALICE and how you can get essential tools for financial success if you are in this demographic.

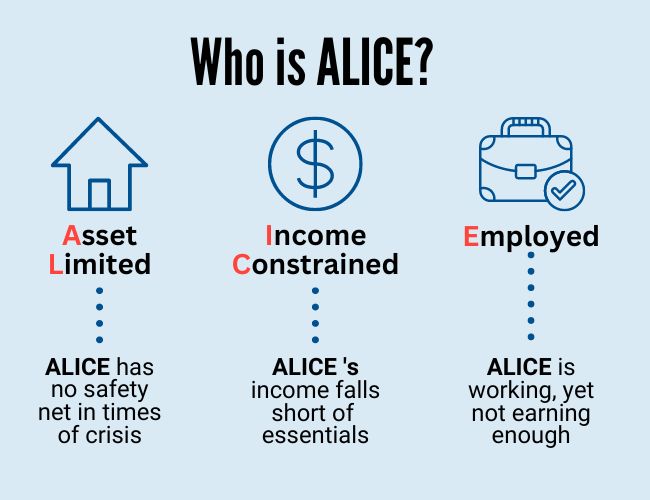

Who Is ALICE?

ALICE households are those with working individuals who earn income above the official federal poverty level (FPL)—which is both outdated and inaccurate—but below the real cost of living. Essential but low-income or minimum-wage workers like restaurant waitstaff, childcare providers, and grocery store employees are often part of the ALICE group. Families of color are disproportionately represented in it, as are people with disabilities, along with many other individuals coping with educational, financial, or social disadvantages.

These individuals and families are living within the parameters of a metric known as the ALICE Income Threshold. Unlike the FPL, this threshold reflects the actual minimum income level needed for a household to survive in the US today.

Unfortunately, households that earn just enough to survive are often unable to save for emergencies or retirement, and many are one unexpected expense away from financial disaster. This is because a dizzying rabbit hole of systemic social and financial barriers make it difficult for ALICE individuals to gain secure financial footholds.

Barriers to Prosperity for ALICE Individuals and Families

Here are just some of the major obstacles that keep ALICE populations from building a secure financial future for themselves and their families.

Unaffordable Higher Education, Student Debt, and Low Wages

One of the key barriers to financial stability for low-income individuals is the exorbitant cost of a college education. Although generations of Americans have been urged to go to college, higher education is difficult to afford even for middle-class families, driving millions of Americans to either take on towering student loan debt or skip higher education altogether. Yet without a college degree, it can be difficult to find a job that pays a living wage, and this wage gap is a prosperity-shrinking cocktail for ALICE individuals trying to improve their financial situation.

Many ALICE individuals who do have a college degree are working in low-wage jobs that don’t offset the cost of their education. Early childhood educators are an excellent example of this. Although these are highly qualified professionals, their wages are often low because parents who are struggling to cover childcare costs can’t afford preschool tuition. This leaves many college graduates unable to afford major life milestones like having a family or purchasing a house, much less retiring comfortably to a life of croquet games or other enjoyable activities.

Unaffordable Housing

Another major barrier to financial security for ALICE individuals and families is a shortage of affordable housing. In many areas of the country—such as York County, Pennsylvania—the cost of housing has skyrocketed in recent years, making it difficult for low-income individuals to find a place to live that is both safe and safely within their financial means.

As a result, ALICE individuals are frequently forced to spend a large portion of their income on housing, leaving them with little money left over for other expenses. In addition, financial barriers to home ownership mean that housing costs are siphoned off to landlords as rent rather than working to help families build home equity (as mortgage payments do).

This creates yet another financial pitfall for renters: the inability to take out home equity loans for home improvements to increase home resale value, or to make other investments that typically help to build wealth.

Lack of Healthcare Coverage

Healthcare costs can be a significant burden for ALICE individuals, particularly those who do not have access to high-quality health insurance through their employers and who cannot afford insurance plans on an out-of-pocket basis. Without affordable health coverage, ALICE individuals may be unable to access essential preventive care and medical treatment. This can lead to unchecked chronic illnesses, missed work, job loss, high emergency hospital bills, and even premature death.

Unaffordable Childcare

For ALICE individuals with children, the cost of childcare can be a major obstacle to financial stability. This prohibitive expense frequently burdens women in particular with caregiving responsibilities that make it difficult to work full time or pursue education or training that could qualify them for higher-paying jobs.

Consequently, many women either struggle to provide for their families with low-paying part-time earnings, or leave the workforce entirely to depend on the income of male partners. This results in lost income and creates employment gaps that can prevent them from getting high-quality jobs or pursuing satisfying careers in the future. For women who want these things, unaffordable childcare can cause them to lose a significant part of their “muchness” and purpose.

Racial and Gender Inequality

Systemic racism and gender inequality can also be major barriers to financial stability for ALICE individuals. As of 2021, White, non-Latina women in the United States earned just 73 cents for every dollar earned by their male counterparts. This wage gap is even wider for women of color, with Black women earning just 64 cents and Latina women earning just 54 cents for every dollar earned by white, non-Hispanic men. Similarly, communities of color are more likely to live in poverty than White ones.

How To Achieve Financial Stability If You’re ALICE

Ultimately, removing these barriers will require comprehensive reforms to the costs of education and training, housing, healthcare, and childcare in the US, as well as to systemic racial and gender inequality.

In the meantime, ALICE individuals can vote for politicians and legislation that support these reforms and seek out assistance in their communities. There are many government and nonprofit organizations working to empower low-income groups to defeat financial monsters of all feathers and build brighter futures.

For example, United Way of York County is sponsoring a survey of its ALICE population to determine what the greatest gaps in community resource programs currently are so that the organization can support ALICE households more effectively and holistically. In addition to this, United Way of York County strongly advocates for legislation and funding that will help low-income households to thrive.

United Way of York County in Pennsylvania assists working households in our community to achieve financial stability by collaboratively and equitably reducing barriers to prosperity. We offer access to free health and human services, affordable prescription medications, assistance with tax preparation, and more to fight for the education, health, and economic mobility for all members of our community. Contact us to get the services you need for a financially successful future or consider supporting us by making a donation today!